GAP Cover in Wyoming

Guaranteed Asset Protection

What is GAP?

GAP coverage is protection against negative equity should your vehicle become a total loss. In the event your vehicle is declared a total loss by your insurance company, your insurance company may only pay what the vehicle is actually worth at the time of the event. In a lot of cases, this can be less than what you owe to clear(pay off) the loan on the vehicle.

How Does GAP Work?

How Does GAP Work?

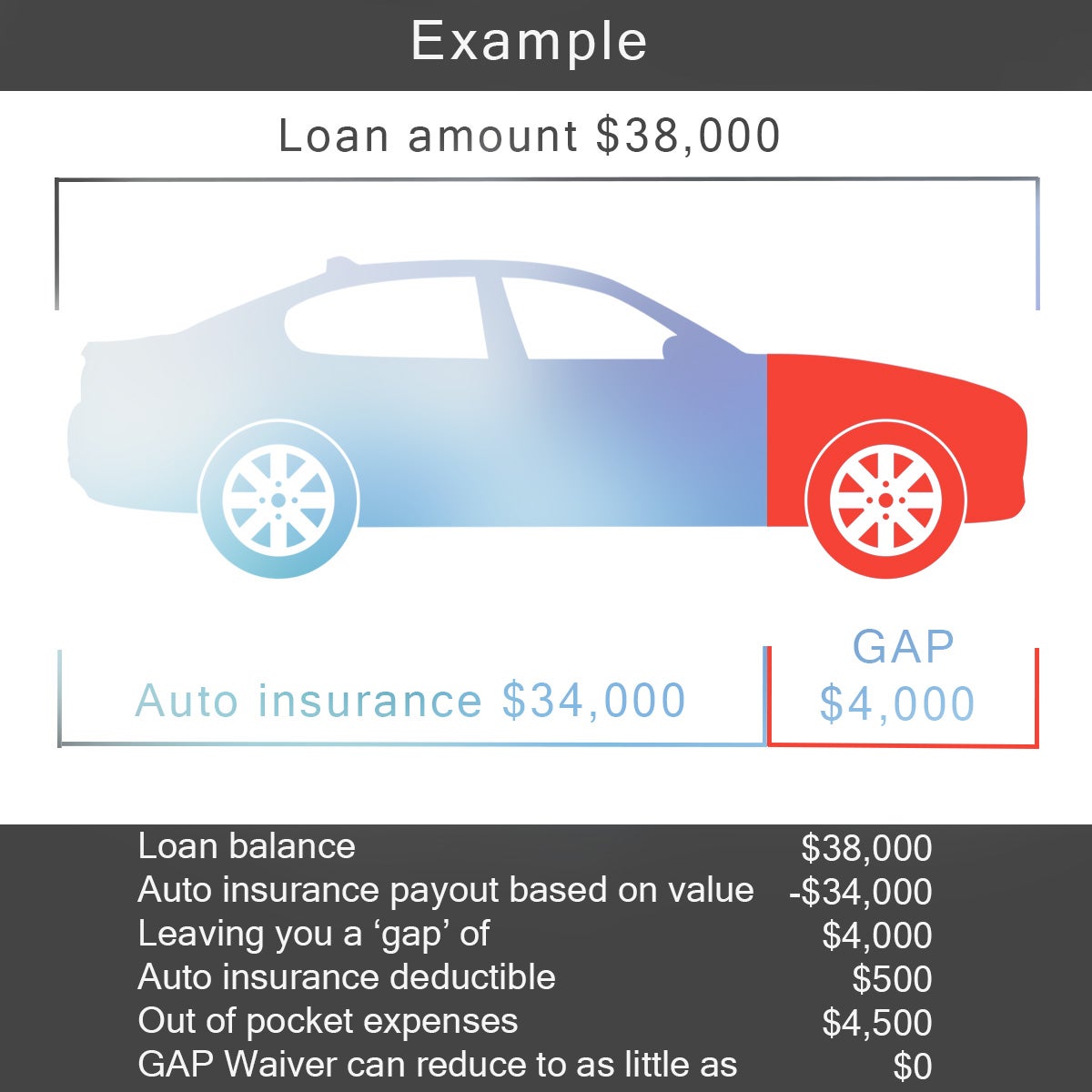

Your auto insurance coverage may not pay off your vehicle loan should your vehicle be stolen or declared a total loss.

For example, you purchase a new vehicle for $40,000. Six months later it's wrecked. Your auto insurance declares the vehicle a total loss and agrees to pay you $34,000, but due to interest on the loan, you may still owe $38,000.

You'd then be financially responsible for the difference of $4,000 and no vehicle.

This is where GAP cover comes in and pays that $4,000 difference so you can be free and clear of your loan.

Coverage is available on new and used cars, trucks, SUVs, crossovers, and minivans, and for loans up to 84 months. Coverage can only be purchased at the same time as purchasing your new vehicle, so you are protected right away.

Reasons you might need GAP

Traded in a vehicle upside down

You may have ended up trading in a vehicle where you still owed more than it was worth (aka being upside down). This is not uncommon. The difference of negative equity is then rolled into the new vehicle loan. For the new loan, this means starting off owing more than the vehicle is worth again. Should the vehicle be written off or stolen near the start of the loan term this could be devastating.

You're a high mileage driver

Car values assume an average yearly mileage. If you drive less than average miles a year, this could help maintain the value of your vehicle, however, if you drive more than average miles, this will decrease the value of your vehicle at a faster rate. The average yearly mileage is around 10,000-15,000, so if you are doing 20,000-30,000 miles per year you can expect your vehicle to lose value quicker.

Long term loan or high-interest loan

Financing a car loan over a longer-term (more than 60 months) means the monthly payments are less, but it usually also means there's more interest to pay. This, in turn, usually means you'll end up upside down and owing more than the vehicle is worth. Having a high-interest loan and or a vehicle that doesn't have a great resale value could also lead to negative equity or being upside down in the loan.